Storage electric analysis energy storage track, how to find a better differentiation scene for house

Storage and Storage Power said: the high demand for household energy storage has accelerated the development of Chinese enterprises overseas. In terms of global market share, Germany, the United States, Japan and Australia have a combined share of nearly 75% of household energy storage. These regions are all countries with high electricity bills without exception, and are strategic places for players of the current household energy storage game.

At present, household energy storage players can be divided into three categories: the first category is the key in the batteries, the channel has advantages such as high quality, brand, some companies even have the whole industrial chain advantage, can for the distributors/system integrator for all-in-one or battery systems, such as Tesla, can send, panasonic, byd auto, too, and other enterprises.?

The second type is dominated by well-known PCS/ inverter power producers and system integration companies (such as photovoltaic power generation). Based on their previous accumulation in mode and information system integration, they enter the household energy storage industry, represented by Enphase, Sonnen, Huawei, Sunpower, Sunhong, and Godway.

The third category mainly refers to the start-up enterprises extending from outdoor/portable storage to household energy storage, such as Delan Minghai, Aopeng, Jianghai, Bianzu, etc.

The discovery of high industrial energy storage shows that the energy storage products used by foreign households tend to be located in electric energy "home appliances". In specific deployment, it is generally dominated by hybrid photovoltaic energy storage system software, that is, the inevitable trend of optical storage integration. In the future, the market for residential energy storage will become as big as the market for home appliances.

Driven by favorable policies, energy shortage, high electricity price and cost reduction of optical storage systems, the market implementation of household energy storage is accelerating in overseas markets.

However, it is necessary to recognize the field. This runway is still in the early stage of market development and design, and it is still in the stage of channel marketing. Distributors/assemblers have prominent regional advantages in terminal equipment. Household energy storage products are gradually moving towards functional diversity; The boundary between portable energy storage in large space and energy storage in home scene is gradually blurred, and "mobile" household storage should come into being. To gain a foothold in the residential energy storage market, a competitive advantage is needed.

Household energy storage is not fundamentally different from lithium-ion battery energy storage systems in other scenarios. For example, a household energy storage system consists of a cell, a battery management system, an energy management system, an energy storage converter, and other support systems (such as thermal management).

As one of the core components of the energy storage system, the energy storage battery system needs to be integrated with the energy storage converter and other components into a complete energy storage system and then provided to the end user. Therefore, there are corresponding links such as system design, integration and installation.

Since system integration involves a large number of electrical equipment and is highly professional, the system integrator generally selects the equipment of the entire energy storage system, purchases or produces energy storage converters and other electrical equipment by itself, and then integrates them with downstream installers, who deliver them to end users after installation and construction.

Because energy storage products are electrical products, installation and adjustment of certain technical professionalism and safety regulations. Therefore, the end customer is not connected to the energy storage brand, but is connected to the channel provider/installer. Combined with different regional policies, power engineering audit standards, market access system in different areas "in the" installer must connect the local government, the electric power enterprise, customers, to access conditions, installation and customization of power engineering quantitative trading strategy needs, such as so short time, distributors/manufacturers of terminal equipment installed region advantages highlighted relativity.

Sent for example, mainly for the energy storage system integrators to provide energy storage battery system (batteries, BMS, EMS), and by the system integrator on the system of energy storage equipment selection, outsourcing or on their own production of stored energy converter and other electrical equipment, matching integration to the downstream of the installer, installer after installation final delivery to the end customers.

It is understood that there are two ways to cooperate with PI energy technology: input independent brands with PV/energy storage integrators; For big brands, Peinergy Technology supplies Sonnen, Europe's largest energy storage system integrator, with branded products. Downstream installers deliver to end users after installation and construction.

"Bonus Points" for adult household Storage Products with diversified Functions

From the perspective of market development, the scenario of household energy storage has gradually reached the functional requirements and gradually iterated towards intelligent system products. Product force will be one of the key to break the bureau of the household storage company.

For example, Tesla Powerwall self-powered mode and time-sharing control mode can meet higher usage requirements. The Powerwall will charge when the system produces excess solar energy, and the energy stored in the Powerwall will be used when the home needs more electricity than the solar system can provide. When enough solar energy is generated to offset the home's current consumption and the Powerwall is fully charged, the excess solar energy is exported to the grid.

Time-sharing control means that if a customer's electricity price changes over the course of the day (TOU), the customer can use a time-sharing plan to intelligently charge and discharge the Powerwall by adjusting the charging and discharging times to provide the best economic value for the customer's system.

In addition, disaster warning, intelligent system, connected with new energy electric vehicles, modular design expansion and other functions also help the household storage and sales market to increase the development trend of upgrading ideas. For example, storm warning, automatic weather tracking system, real-time monitoring system of solar power station conditions, the use of renewable resources to carry out battery charging for new energy vehicles and other diversified functions, also make household energy storage system to the direction of super home appliances

In addition to the above "cool" features, the underlying logic of the household energy storage system is the same as other products: care about the service life of the product, etc. High-tech energy storage technology has been sorted out from the promotion points of various brand household storage products. The service life and safety factor of household energy storage system are still the key to compete for the market.

Where is the "mobile" home storage market?

According to the classification of previous players, many portable energy storage enterprises have started to enter the residential energy storage scene to find new growth points. Unlike existing household storage players, portable storage players are tapping into the trend of higher and higher outdoor/portable storage capacity, and "mobile" household storage is becoming the main route for such players.

From the perspective of product form, it is equivalent to the extension of large capacity portable energy storage. Stacking products and modules for capacity expansion; Positioning is also more flexible, which can meet the emergency needs of several kilowatt-hours of electricity, and can also be extended to the backup power supply of the whole house. Taking into account outdoor use properties, such as outdoor activities, outdoor gardens, RV and other scenes, through the design of mobile wheels or moving a battery module can be realized.

Industry insiders said that there is no certain standard assembly of light storage integration (such as apartment buildings), only on the disconnect condition of emergency electricity there are requirements, and the pursuit of perfect lower cost, shorter implementation cycle and more flexible use steps, this product form application of indoor space is relatively large.

While the line between large-space portable storage and home storage is becoming less clear, there is still a long way to go in terms of practical aspects, such as how to improve product safety and how to align with local energy storage subsidies.

The competitive power should be core

Despite the emergence of new forms, the industry generally agrees that the stable supply of cells, channel building, team and R&D capabilities are still the key to the residential energy storage circuit.

Since last year, many energy storage integrators have not seen as big a jump in shipments as the demand side of the market. The core problem is the supply of batteries. In addition, some enterprises do not take household energy storage as a major product line to supply, and the market is seriously out of stock.

In addition, in the household energy storage circuit, the channel is still one of the very key factors. For example, there is a high overlap between the existing channel providers and the photovoltaic channel providers. Some old inverter/energy giants also have a deep accumulation in the channel, so Huawei, Goodway, Sunshine Power Supply and other enterprises can rise rapidly.

There is a saying in the industry that team and research and development ability can determine how far an enterprise can go. The same can be said for the residential energy storage market. For example, thermal management and BMS are the most vulnerable parts of energy storage, which also directly affect the life of energy storage system.

It is worth mentioning that the current household energy storage is mainly promoted by online and offline channels. Online rely on third-party evaluation websites, e-commerce websites, offline through integrators/installers. Although several industry giants such as Tesla, Peineng Technology, BYD, Huawei and Sunpower are dominant in their respective regional markets, brand barriers have not been really established in the industry. For example, this year's listing of First Air New Energy in the household storage sector is also very impressive performance, and Ningde Times is one of its shareholders.

The industry believes that, into the office storage circuit, the first is to ensure the safety of cell supply. Secondly, to the quality of safe and reliable products into the market. In addition, how to find better differentiation scenarios to improve user experience is also a concern. Generally speaking, only by creating core competitiveness can we win more market opportunities and consumers' favor.

Disclaimer:

1. Some articles and pictures come from high-tech lithium energy;

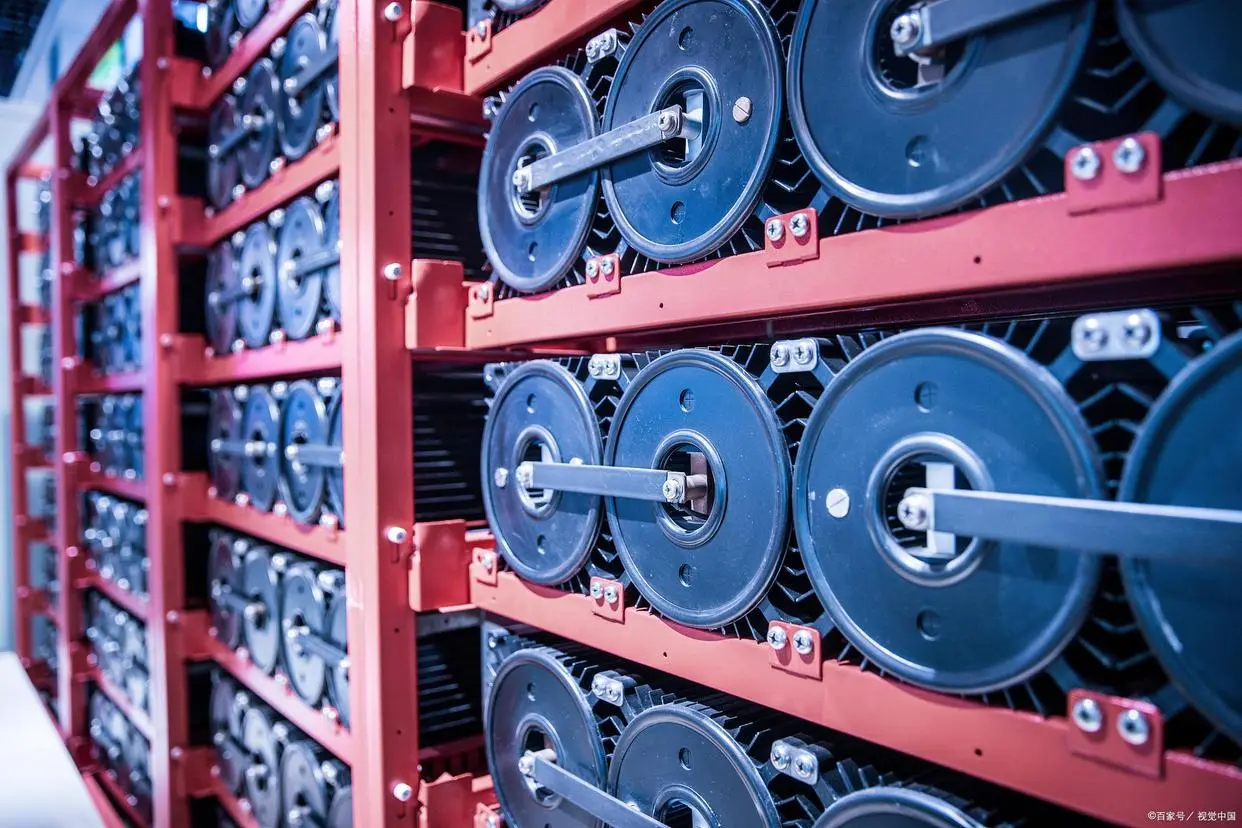

2. Due to editing needs, there is no necessary connection between the text and the picture. It is only for readers' reference and does not represent the views of the platform, nor does it constitute investment advice or decision-making advice, nor does it provide material for any user transaction.

3. We have reproduced all the articles, pictures, audio video file information such as copyright belongs to the copyright shall belong to the original people, because of the original articles and pictures, etc can't contact and copyright, such as the author or editor that work should not be access to the Internet for everyone to browse, or should not be used free of charge, or involve copyright issues, please inform us in time, to take appropriate measures to quickly Avoid causing unnecessary economic losses or copyright disputes to both parties;

4. If this website infringes the intellectual property rights of media or individuals unintentionally, please contact us within 30 days after the publication of the article. We will delete the content as soon as possible, thank you.